Question: What Are the Problems With Foreclosed Properties? Answer: The problems with foreclosed properties include being sold ‘as is,’ often in poor condition with no seller disclosures. Buyers may face significant repair costs, property liens, and challenges with existing occupants. The legal process can also be complex, and financing might be more difficult to secure. […]

How Distressed Properties Affect Your Home’s Value A well-maintained street with manicured lawns and homes in good repair projects an image of stability and desirability. The sudden appearance of a ‘For Sale’ sign on a foreclosed property can disrupt this harmony. Homeowners often worry about how foreclosures impact nearby property values. This concern is valid […]

Question: What are Commercial Property Valuation Techniques? Answer: The primary commercial property valuation techniques are the Direct Comparison Approach (analyzing similar sold properties), the Income Approach (valuing based on net operating income), and the Cost Approach (determining replacement cost less depreciation). A combination is often used to determine fair market value. How Commercial Properties are […]

Question: What is the Difference Between Commercial and Residential Valuation? Answer: Residential valuation primarily uses the Direct Comparison Approach, analyzing sales of similar homes. Commercial valuation is more complex, emphasizing the Income Approach, which bases value on a property’s ability to generate income, alongside cost and comparison methods. Commercial vs Residential Property Values Property valuation […]

How Real Estate Investors Assess Property Worth Real estate investing offers a powerful path to building wealth. Many investors begin with residential properties before exploring commercial options. A frequent point of confusion is how professionals value these two distinct asset classes. The methods are fundamentally different, and using the wrong one can lead to poor […]

Question: How Do I Get Around Eminent Domain? Answer: You generally cannot get around eminent domain (expropriation in Canada). However, you can challenge it by proving the action is not for public use. More commonly, property owners hire an attorney to negotiate or litigate for higher, “just compensation” than what was initially offered. Can You […]

Question: Can the Government Take Your Property in Canada? Answer: Yes, the government can take your property in Canada through a process called expropriation. The government can take private property for a public purpose, like building a highway. The government must provide fair market value compensation to the owner for the land. The Government’s Right […]

Question: What is the Right Of Eminent Domain Canada? Answer: In Canada the right of eminent domain is called expropriation. It is the right of federal and provincial governments to take private property for public use, provided that the owner receives fair compensation as required by law. The Government Power to Take Private Property You […]

How Government Land Acquisition Affects Your Property’s Worth You may have heard the term eminent domain. In our local context, we call it expropriation. It describes a government’s power to take private property for public use. This process can feel overwhelming for any homeowner. Imagine receiving a notice that your land is needed for a […]

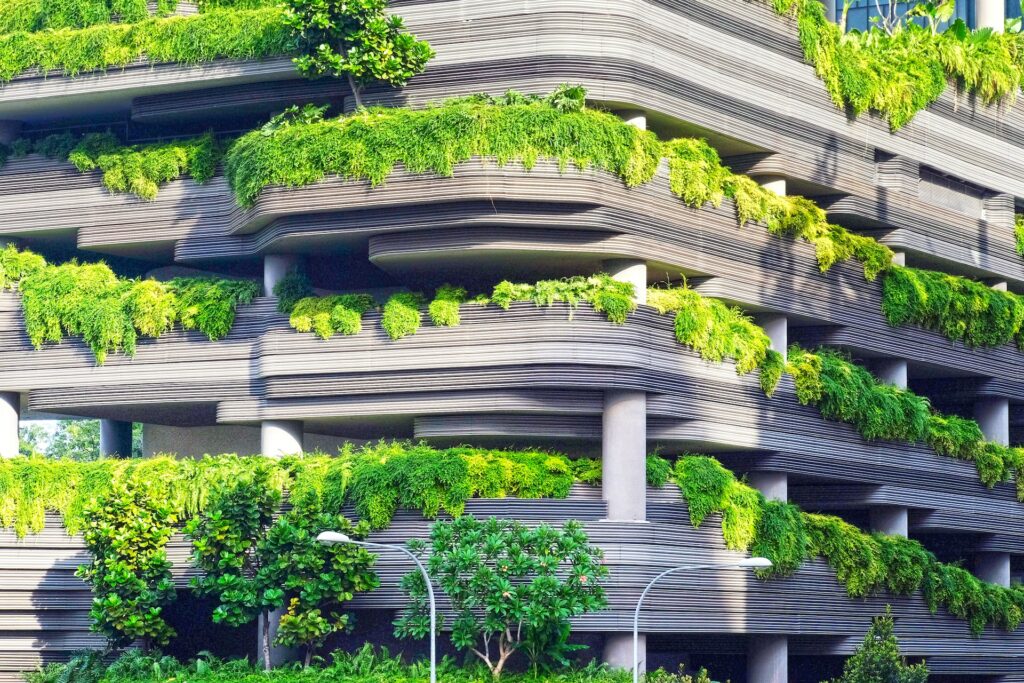

Question: How Do You Create Value in Architecture? Answer: You can create value in architecture by solving client problems and enhancing user experience. This involves balancing aesthetics, functionality, sustainability, and budget to create efficient, inspiring spaces that provide a clear financial, social, and cultural return on investment for all stakeholders. Building Worth: An Architect’s Method […]

Question: What Are the Positive Effects of Modern Architecture? Answer: Modern architecture’s positive effects include its emphasis on functionality and simplicity. The use of new materials like steel and glass creates open, light-filled spaces with abundant natural light and ventilation, which can improve well-being and foster a greater connection between the interior and the outdoors. […]

Question: What are the Benefits of Design to Value? Answer: The benefits of Design to Value include greater profitability and customer satisfaction by aligning product features with what customers truly value. This process optimizes costs, eliminates non-valued features, and strengthens market position by delivering superior value at a competitive price point. The Advantages of Designing […]

Question: What is the Impact Factor of Architectural Design? Answer: The impact factor of architectural design isn’t a single metric, but a collection of elements that add tangible value to real estate. These include factors like enhanced curb appeal, improved functionality, energy efficiency, and a higher resale value, all of which contribute to a property’s […]

Question: How Does Architecture Add Value? Answer: Architecture adds value by creating functional, beautiful, and sustainable environments. It enhances human well-being, increases property worth, improves efficiency, and strengthens community identity, transforming spaces into valuable social and economic assets. The Tangible Worth of Thoughtful Design People often see architecture as an art form. They admire beautiful […]

How Architectural Styles Affect Your Home’s Worth The design of a home extends far beyond its appearance. Architectural trends directly influence a property’s appeal, functionality, and ultimately, its market price. A home’s layout, materials, and features reflect the lifestyle priorities of its era. As these priorities shift, so do the architectural elements that buyers value […]

Question: Can You Sell Your House for a Dollar in Canada? Answer: Yes, legally you can sell your house for a dollar in Canada as $1 is valid consideration. However, the Canada Revenue Agency (CRA) will likely deem the sale to be at Fair Market Value. This means the seller could still be liable for […]

Question: What is The Capital Gains Exemption in Canada? Answer: The Capital Gains Exemption, or Lifetime Capital Gains Exemption (LCGE), is a tax deduction allowing individuals to shelter gains from selling qualified small business shares or qualified farm/fishing property. A lifetime cumulative limit, indexed to inflation, applies, making a significant portion of the gain tax-free. […]

Question: What is a Property Valuation for Capital Gains? Answer: A Property Valuation for Capital Gains is a professional assessment of a property’s market value on a specific date. It is required by tax authorities to accurately calculate the taxable profit (the capital gain) made from its sale or disposal. Understanding Property Valuation for Capital […]

Property Value for Your Taxes Every homeowner receives a property assessment notice. This document is a key part of your homeownership journey. It shows the value your local government assigns to your property. This value directly influences your annual property tax bill. Understanding this process helps you manage your finances and ensure you pay a […]

Question: What Document Describes the Condition of the Property? Answer: The document describing the property’s condition is typically a Property Condition Disclosure Statement or a Seller’s Disclosure. This form is completed by the seller and details their knowledge of the property’s features and any known issues or defects. Understanding the Key Property Condition Document Buying […]

Question: Which Disclosure is Most Commonly Required in Residential Real Estate? Answer: The Seller’s Property Disclosure Statement is most commonly required in residential real estate. It’s a form where sellers reveal known material defects and information about the property’s condition and history to protect the buyer. Mandatory Disclosures in Home Sales When you sell a […]

Question: Do You Have to Disclose Fire Damage When Selling a House in Ontario? Answer: In Ontario, sellers are legally required to disclose any material latent defects, including fire damage, that may affect the property’s value or safety, ensuring transparency and protecting buyers’ interests. Disclosing Fire Damage in a Real Estate Transaction In any real […]

Question: What is the Appraisal Condition Clause in Ontario? Answer: The Appraisal Condition Clause in Ontario allows a buyer to make a property offer contingent on a satisfactory property appraisal. Understanding the Appraisal Condition Clause in Real Estate Deals In any real estate transaction, the appraisal condition clause serves as a critical tool for managing […]

How a Property’s Condition Shapes Its Value When determining a home’s market value, its physical condition plays one of the most significant roles. Buyers and appraisers meticulously evaluate every aspect of a property, from its charming curb appeal to the unseen structural components. A well-maintained home signals care and reliability, which directly translates into a […]

Question: What to Avoid When Renovating? Answer: When renovating, it’s important to avoid poor planning, overspending, neglecting necessary repairs, cutting corners on quality, and ignoring building codes to ensure a successful and cost-effective outcome. What to avoid when renovating? Steering Clear of Renovation Pitfalls Embarking on a renovation without a clear plan can be like […]

Question: What is The Most Expensive Part of Renovation? Answer: The most expensive part of a renovation is often structural work, like foundation repairs or roof replacements. High-end finishes and kitchen remodels can also contribute significantly to expenses. What is the Most Expensive Part of Renovation? Where Does Your Money Go? When it comes to […]

Question: Should You Incorporate to Flip Houses? Answer: Whether to incorporate for flipping houses depends on factors like liability protection, tax implications, and business structure preferences. Consulting with legal and financial professionals can help determine the best approach for your situation. Should You Incorporate to Flip Houses? Weighing the Tax Implications Flipping houses, or the […]

Question: Why Renovate a Home Before Selling? Answer: Renovating a home before selling can enhance a home’s appeal, potentially increasing its market value and attracting more buyers, resulting in a quicker sale. Why You Should Renovate a Home Before Selling? Maximizing Home Value Selling a home is, in many ways, like packaging a product for […]