Question: Is It Good to Shop Around for Realtors? Answer: Yes, it’s absolutely good to shop around for realtors. It’s a crucial step. You can compare marketing plans, commission structures, and personalities to find the perfect fit. This ensures you partner with an expert who understands your needs before committing to a representation agreement. Why […]

Question: Can a Realtor Tell You What Other Offers are in Canada? Answer: A realtor can sometimes tell you what other offers are in Canada. A Realtor must disclose the number of offers but can only share details like price or terms if the seller gives explicit direction to do so with all bidders. This […]

Question: Does the Buyer Pay Commission to the Realtor in Ontario? Answer: No, the buyer does not pay commission to the Realtor in Ontario. The seller pays the total commission from the sale proceeds, which is shared with the buyer’s brokerage. Your representation agreement will detail the commission and any potential shortfall you might have […]

Question: Is It Safe to Buy a House Without a Realtor? Answer: It can be safe to buy a house without a realtor, but it carries significant risks. You become responsible for market research, negotiations, and navigating complex paperwork. A real estate lawyer is essential to review the purchase agreement and protect your legal rights, […]

Question: Is It Better to Go with a Local Realtor? Answer: Yes, it is better to go with a local realtor. A local realtor provides unmatched knowledge of neighbourhood values, market trends, and community amenities. Their established professional network and understanding of local bylaws give you a distinct advantage, ensuring a smoother and more successful […]

Question: What to Expect from a Real Estate Agent When Buying? Answer: When buying, you can expect a real estate agent to provide market insights, guide you through the buying process, arrange property viewings, negotiate on your behalf, and assist with paperwork. They should also ensure you understand all aspects of the purchase. Partnering with […]

Question: What are Good Questions to Ask a Realtor When Buying? Answer: Good questions to ask a realtor are about their experience in your desired neighbourhood, how their commission is structured, and how they’ll represent your interests. Inquire about their communication style and ask for an explanation of the Buyer Representation Agreement before signing anything. […]

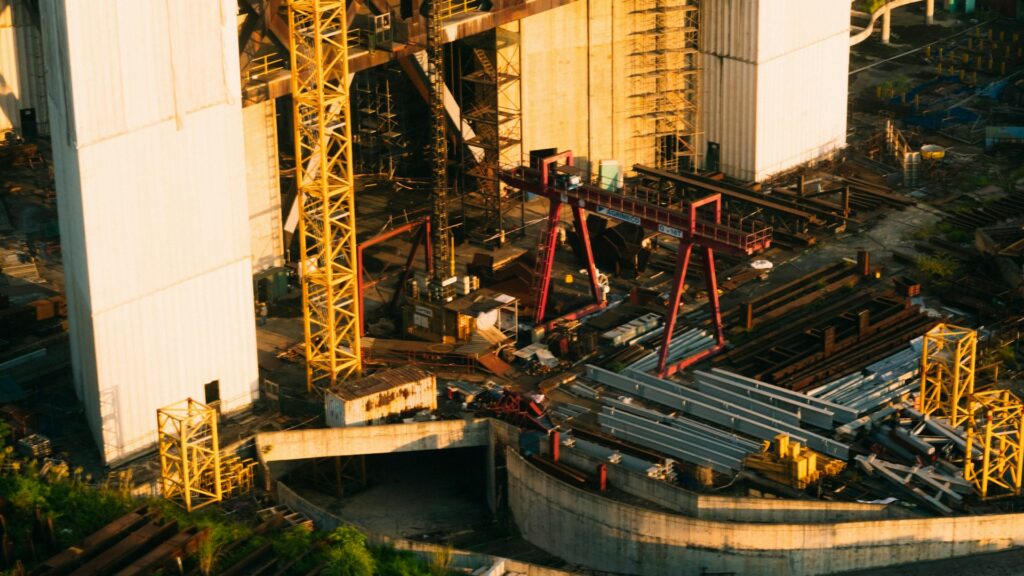

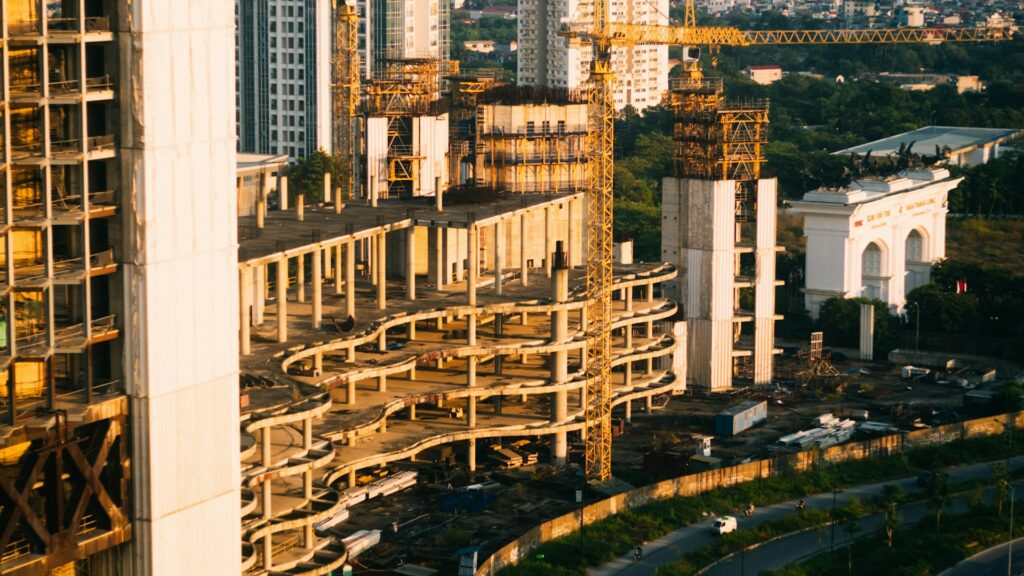

Question: What Does Gentrification Look Like? Answer: Gentrification looks like a neighbourhood transformation marked by rising property values, new developments, and renovated homes. Local businesses are often replaced by trendy cafes and boutiques, leading to the displacement of long-term residents as rents and living costs increase. Identifying the Signs of Neighbourhood Change People often wonder […]

Question: What Is Green Gentrification? Answer: Green gentrification is when environmental improvements like new parks or sustainable developments in a neighbourhood increase property values. This process can raise housing costs, ultimately displacing long-term, lower-income residents who can no longer afford to live in their newly desirable community. The Concept of Green Gentrification Cities across the […]

Question: What Is Gentrification and What Are Some of Its Advantages and Disadvantages? Answer: Gentrification is the revitalization of a lower-income urban neighbourhood by wealthier newcomers. Advantages include increased property values and new investment. Disadvantages include the displacement of long-time residents due to rising rents and a loss of community character. The Benefits and Drawbacks […]

Question: Where Do People Go After Being Gentrified? Answer: After being gentrified, displaced residents often seek affordable housing in other neighbourhoods, nearby suburbs, or different municipalities. This move to less expensive areas frequently results in longer commutes and the loss of established community ties, pushing people further from urban centres. Relocation Patterns After Neighbourhood Change […]

Question: Who Is Most Affected by Gentrification? Answer: Those most affected by gentrification are low-income renters, especially within racialized communities, are most vulnerable to displacement from soaring rents and evictions. Seniors on fixed incomes face rising property taxes, while local businesses are often priced out, fundamentally changing a neighbourhood’s character and affordability for long-time residents. […]

Question: Can Gentrification Be a Good Thing? Answer: Gentrification can be a good thing. It can revitalize neighbourhoods through new investment and increased property values. However, it often causes rising rents and property taxes, which can displace long-term residents and tenants, raising significant concerns about housing affordability and a community’s unique character. The Potential Benefits […]

Question: What Is the Threat of Gentrification? Answer: The primary threat of gentrification is the displacement of long-term, lower-income residents and businesses as rising property values increase rents and taxes. This erodes a neighbourhood’s cultural character, fractures communities, and reduces the overall stock of affordable housing. The Impact of Neighbourhood Change Urban neighbourhoods are always […]

Question: How to Revitalize Without Gentrification? Answer: To revitalize without gentrification focus on community-led strategies. Implement inclusionary zoning to create mixed-income housing, strengthen tenant protections and rent control to prevent displacement, and support local small businesses. Community land trusts can ensure long-term affordability, preserving the neighbourhood’s character while it improves. Revitalizing Neighbourhoods Without Displacing Residents […]

Question: What Are the Pros and Cons of Gentrification? Answer: Pros of gentrification include increased property values, new investment, and revitalized infrastructure. Cons centre on displacing long-term residents through rising rents and taxes, loss of cultural identity, and a higher cost of living for the original community. The Benefits and Downsides of Urban Change Neighbourhoods […]

Question: How Does Gentrification Affect the Environment? Answer: Gentrification has mixed environmental effects. It can increase density, promote green building retrofits, and redevelop contaminated lands. However, it also generates significant construction waste from demolition, increases consumption in neighbourhoods, and can displace residents, potentially leading to longer, carbon-intensive commutes for them. The Environmental Side of Neighbourhood […]

Question: How Does Gentrification Lead to Poverty? Answer: Gentrification can lead to poverty by driving up rents and property taxes and displacing lower-income residents. Forced to move to neighbourhoods with fewer jobs and weaker support services, these households face increased financial instability, which can push them into poverty or deepen existing hardship. The Link Between […]

Question: What Makes a Neighbourhood Gentrified? Answer: What makes a neighbourhood gentrified is a process of change where new investment and wealthier residents arrive. This drives up property values and rents, often displacing long-time community members and altering the neighbourhood’s original character and culture. Neighbourhood Transformation The term gentrification often appears in discussions about urban […]

Question: Does Gentrification Affect Mental Health? Answer: Yes, gentrification can significantly affect mental health. For long-term residents, rising housing costs and the threat of displacement often cause severe stress and anxiety. The erosion of community support networks can also lead to feelings of isolation and depression, affecting overall well-being. The Mental Health Impact of Changing […]

Question: How to Tell If an Area Will Gentrify? Answer: To tell if an area will gentrify, look for new public transit projects, an influx of trendy cafes and boutiques, a surge in home renovations, and a noticeable increase in younger, professional residents. These signs often precede significant growth in property values and rental demand. […]

Question: What Is the Paradox of Gentrification? Answer: The paradox of gentrification is the contradiction where the process of revitalizing a neighbourhood with new investment and amenities leads to rising costs that displace the original, lower-income residents who were ostensibly supposed to benefit from the improvements. The Two Sides of Neighbourhood Change Many people see […]

Question: Does Gentrification Ever Reverse? Answer: Yes, gentrification can reverse though it’s very uncommon. This process, called de-gentrification, can occur during severe economic downturns or when a neighbourhood loses its appeal. Investment dwindles, property values can fall, and the area’s economic trajectory shifts, sometimes leading to a demographic reversal. Can a Gentrified Neighbourhood Ever Go […]

Question: What Are the First Signs of Gentrification? Answer: The first signs of gentrification include an uptick in home renovations, rising rents, and the arrival of new businesses like specialty cafes or art galleries. This often precedes a demographic shift and significant changes to the neighbourhood’s character and affordability. The Early Indicators of Neighbourhood Change […]

Question: Is Gentrification Beneficial on Average? Answer: While gentrification can revitalize a neighbourhood by boosting property values and attracting investment, these benefits are not shared equally. It frequently leads to the displacement of long-term residents due to soaring rents and property taxes, creating significant social challenges and making its overall benefit highly contentious. The Overall […]

Question: What Are Indicators of Gentrification? Answer: Key indicators of gentrification include rapidly rising property values and rents, an influx of higher-income residents, and new businesses like cafes and boutiques replacing older shops. This often results in the displacement of long-term residents from a changing neighbourhood. Recognizing the Signs of a Changing Neighbourhood Urban neighbourhoods […]

Question: What Is the Difference Between Gentrification and Revitalization? Answer: Revitalization aims to improve a community’s infrastructure and services for current residents, often with their involvement. Gentrification is market-driven change where wealthier newcomers displace long-time residents and local businesses due to rising costs, altering the neighbourhood’s character. The key difference is displacement. Gentrification vs Revitalization […]

Question: What Is the Alternative to Gentrification? Answer: The alternative to gentrification is equitable development, focusing on revitalization without displacement. This involves strategies like inclusionary zoning, stronger tenant protections, and community land trusts to ensure long-term residents can afford to stay and benefit from neighbourhood improvements. Pathways Beyond Neighbourhood Displacement Urban neighbourhoods constantly change. New […]