Question: Can You Pay a Down Payment with a Credit Card? Answer: While it’s technically possible to pay a down payment with a credit card, most sellers and lenders don’t accept this method due to the high transaction fees and potential risk of default. However, some alternative financing options may allow for using a credit […]

Question: Can You Borrow Money for a Down Payment? Answer: Yes, some lenders allow borrowers to use borrowed funds, such as personal loans or lines of credit, for the down payment on a home purchase. However, this practice may increase your debt-to-income ratio and affect your mortgage eligibility and terms. Can You Borrow Money for […]

Question: What is the Green Building Rating System in Canada? Answer: The primary green building rating system in Canada is LEED (Leadership in Energy and Environmental Design). Administered by the Canada Green Building Council (CaGBC), it is a third-party certification program that evaluates a building’s environmental performance and encourages sustainable design, construction, and operation practices. […]

Question: What is LEED Green Certificate? Answer: LEED (Leadership in Energy and Environmental Design) is a globally recognized green building certification. It verifies a building is designed for high performance in key areas of human and environmental health, including energy savings, water efficiency, and reduced CO2 emissions, creating a healthier, more sustainable space. The LEED […]

Question: What is the Green Certification Standard? Answer: Green certification standards are third-party programs that assess the environmental impact of products, buildings, or services. They provide a verifiable benchmark for sustainability, helping consumers and businesses identify genuinely eco-friendly options through ratings or labels like LEED or ENERGY STAR. Green Certification Standards for Homes Many homebuyers […]

Question: What are the Four Most Environmentally Friendly Building Materials? Answer: The four most environmentally friendly building materials include bamboo, for its rapid renewability; rammed earth, for its low-impact local sourcing; reclaimed materials like wood and steel, which reduce waste; and cork, harvested without harming trees, are four top choices for sustainable building. Finding the […]

Question: What is the Cheapest Renewable Energy System for the Home? Answer: Solar photovoltaic (PV) panels are generally the cheapest renewable energy system for the home, thanks to falling costs and incentives. The true cost depends on location, sunlight, and available rebates. A solar water heater is often a more affordable alternative focused solely on […]

Question: Can I Put a Small Wind Turbine on My Roof? Answer: While possible to put a small wind turnbine on your roof, it is often not recommended. The turbine’s weight and vibrations can damage your home’s structure, and performance is poor due to turbulent wind. You must first check local building codes, zoning laws, […]

Question: What is the Best Renewable Energy Source for Homes? Answer: The best renewable energy source for homes is typically solar panels, thanks to their versatility and falling costs. However, the ideal choice depends on location and property. Geothermal is excellent for consistent heating/cooling, while small wind turbines can be viable in windy, open areas. […]

Question: What are the Disadvantages of Eco-Friendly Materials? Answer: The disadvantages of eco-friendly materials often include higher costs, potentially lower durability or performance compared to traditional alternatives, and limited availability. Sourcing and manufacturing can also be more complex, making them less accessible for widespread use and sometimes requiring specialized maintenance or disposal. The Downsides of […]

Question: What are 5 Things You Do at Home To Be Eco-Friendly? Answer: To be eco-friendly, you can reduce waste by recycling and composting, conserve energy with LED bulbs and unplugging electronics, save water with shorter showers, use reusable bags and containers, and switch to non-toxic cleaning products. These simple changes significantly reduce your environmental […]

Question: How Can I Retrofit My Old House for Energy Efficiency? Answer: To retrofit your old house for energy efficiency, start with an energy audit. Prioritize sealing air leaks and adding insulation to the attic, walls, and crawlspace. Upgrade to energy-efficient windows and doors, replace old appliances with ENERGY STAR models, and consider a high-efficiency […]

Question: Are Green Buildings More Ecological and Cost Effective? Answer: Yes, green buildings are more ecological and cost effective by reducing resource consumption. While initial costs can be higher, they prove cost-effective long-term through significant savings on energy and operational expenses, providing a strong return on investment. The True Value of Green Buildings Homebuyers and […]

Question: What are the Economic Benefits of Sustainable Design? Answer: The economic benefits of sustainable design include lower operational costs through energy and water efficiency, increased property values, and improved occupant productivity. It can also enhance brand reputation and provide access to tax incentives, ensuring a strong long-term return on investment. The Financial Advantages of […]

Question: What are Some Interesting Facts About Eco-Friendly Houses? Answer: Some interesting facts about eco-friendly houses include: they can feature living roofs that lower energy bills, insulation made from recycled denim, and passive solar designs that can cut heating costs by 50%. Many also use rapidly renewable materials like bamboo, which grows exceptionally fast. Surprising […]

Question: What are the Examples of Things We Can Find in an Eco-Friendly Home? Answer: Examples of things we can find in an eco-friendly home include solar panels, Energy Star appliances, low-flow water fixtures, and LED lighting. You might also see sustainable materials like bamboo flooring, non-toxic paint, a compost bin, and double-paned windows for […]

Question: How Do You Build an Eco-Friendly House? Answer: To build an eco-friendly house start by using sustainable materials like bamboo, incorporating energy-efficient designs with solar panels and superior insulation, and implementing water-saving systems. Prioritizing a smaller footprint and passive solar design are also key for reducing environmental impact. Constructing Your Sustainable Home Building a […]

Question: What are the Pros and Cons of Green Building? Answer: Pros of green building include lower energy costs, improved occupant health, and reduced environmental impact. Cons are the higher initial construction costs and the potential for limited availability of specialized materials and labor in certain areas. The Advantages and Disadvantages of Green Homes Many […]

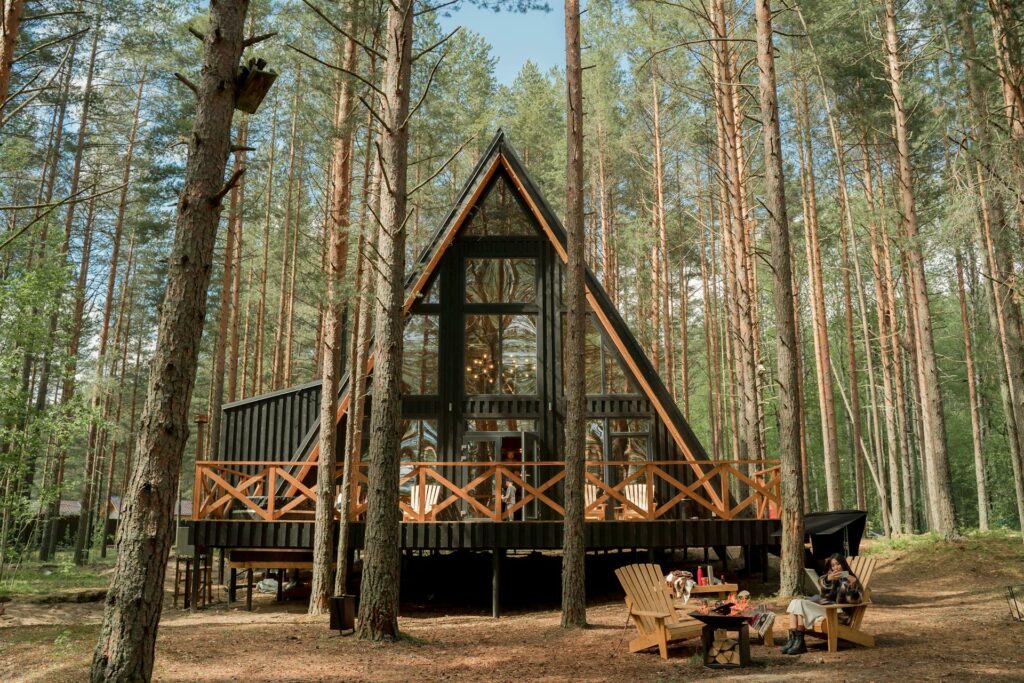

Question: Can You Permanently Live in a Cottage? Answer: Yes, but it depends on local zoning laws and planning permissions. The cottage must meet residential building codes for year-round living, including proper insulation and utilities. Some communities may also have rules restricting permanent occupancy, so always check local regulations before moving in permanently. The Dream […]

Question: What Are the Benefits of Owning a Cottage? Answer: Some of the benefits of owning a cottage include: A cottage offers a private retreat for relaxation and connecting with nature. It’s a place to create lasting family memories, enjoy outdoor recreation, and can provide rental income, making it both a valuable lifestyle and financial […]

Question: Is a Cottage a Good Investment in Canada? Answer: A cottage can be a good investment in Canada, offering personal enjoyment and potential financial gains through appreciation and rental income. Success depends on location, market trends, and managing costs like maintenance and taxes. It’s a blend of a lifestyle choice and a financial commitment […]

Question: What Are the Disadvantages of Owning a Cottage? Answer: Disadvantages of owning a cottage include significant ongoing expenses like taxes, insurance, and maintenance. It also demands a substantial time commitment for upkeep and travel, which can limit your financial and personal flexibility for other types of vacations or activities. The Downsides of Cottage Ownership […]

Question: What is Vacation Property Insurance? Answer: Vacation property insurance is a specialized policy for a secondary home, like a cabin or cottage. It provides property and liability coverage, addressing the unique risks of a property that is not your primary residence and may be vacant for extended periods. Insurance for Your Vacation Home Owning […]

Question: Can a Husband and Wife Have Separate Primary Residences in Canada? Answer: Yes, a husband and wife can have separate primary residences in Canada. However, for tax purposes, a family unit can only designate one property as their principal residence for any given year to claim the full capital gains tax exemption. Separate Homes […]

Question: How Does CRA Determine Primary Residence? Answer: The CRA determines your primary residence by reviewing where you ordinarily inhabit the home, considering facts like the address on your ID, tax filings, and personal ties to the property. No single factor is decisive; it depends on the specifics of your situation. The CRA’s View on […]

Question: Can I Make My Cottage My Primary Residence? Answer: Yes, you can make your cottage your primary residence, provided local zoning bylaws permit year-round occupancy and the property is winterized with year-round access. You must also formally change your address with government agencies for tax, voting, and healthcare purposes to officially establish it as […]

Question: What Are the Tax Implications of Owning a Second Home in Canada? Answer: The primary tax implication of owning a second home in Canada is the capital gains tax on increased value when you sell, as only one property can be designated your principal residence. Any net rental income is also taxable. Some provinces […]

Question: How Do I Avoid Paying Capital Gains on a Cottage? Answer: To avoid paying capital gains on a cottage, you can designate it as your principal residence, which shelters the gain from tax. However, you can only designate one property per family for any given year. Strategic estate planning can also help defer or […]