Real Estate News: The Latest, Top Articles in Ontario Canada

Get the most recent real estate news and real estate trends to hit Ontario's housing industry.

Best of Real Estate Articles

Understanding the Role and Requirements of Realtors

Realtor Fees and Commissions

Relocation Information

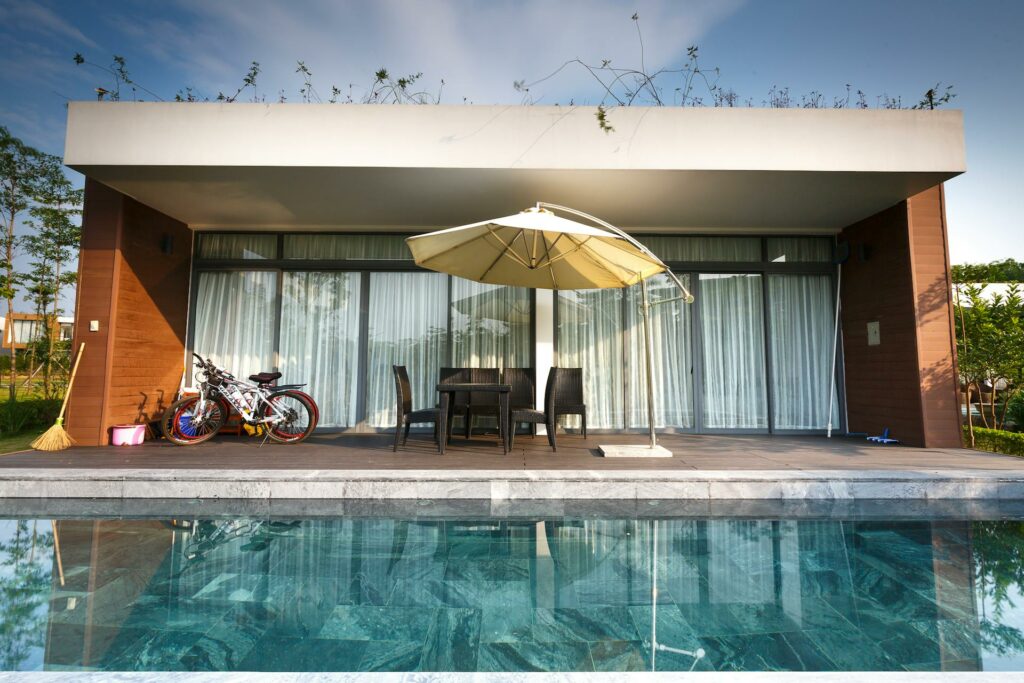

Luxury Property Sales and Marketing

Realtor Selection and Relationship – Forging a Winning Partnership

Navigating Property Matters During a Separation and Divorce

Maximizing Success in Rural Real Estate

Understanding the Investment Property Market

Maximizing Your Commercial Real Estate Success

Helping You Find the Perfect Home for Your Retirement

Estate Sale Experts Can Simplify Your Property Liquidation

First Time Home Buyer Real Estate Info

Latest Articles: Everything Real Estate

Can a Landlord Increase Rent on a Month-To-Month Lease in Ontario?

What Rights Do Tenants Have When the House is Being Sold in Ontario?

What Repairs Are Landlords Responsible for in Ontario?

What Are the Rules for a Month-To-Month Lease in Ontario?

What a Landlord Cannot Do Ontario?

What Are My Rights as a Tenant in Ontario?

Is the Landlord Responsible for Mould in Ontario?

Is it Ok to Buy a House With Tenants?

How Much Notice Does a Landlord Have to Give a Tenant to Move Out in Ontario?

How Do I Complain About a Landlord in Ontario?

Do You Have to Give 60 days Notice At the End of a Lease in Ontario?

Can Someone Live With You Without Being on the Lease in Ontario?

Can I Refuse a Landlord Inspection in Ontario?

Can a Tenant Change the Locks in Ontario?

Can a Landlord Refuse to Renew a Lease in Ontario?

What is a Damage Deposit in Ontario?

What Credit Score is Needed to Rent an Apartment in Ontario?

What Do I Do If the Landlord Does Not Return the Deposit?

Why is Home Insurance So Expensive in Canada?

Which Area is Not Covered By Most Homeowners Insurance?

Which Two Are Not Covered By Homeowners Insurance?

What Type of Home Insurance Has Lowest Premium?

What is the Most Common Deductible On Homeowners Insurance?

What is the Most Common Form of Homeowners Insurance?

What is the Most Basic Homeowners Insurance?

What is Included in Contents Insurance?

What is the Difference Between Standard And Comprehensive Home Insurance?